Groww Nifty 1D Rate Liquid ETF

Invest Now

Fund Manager: |

ETFs |

NIFTY 1D Rate Index

NAV as on 08-01-2026

AUM as on

Rtn ( Since Inception )

5.6%

Inception Date

Sep 20, 2024

Expense Ratio

0.29%

Fund Status

Open Ended Scheme

Min. Investment

0

Min. Topup

0

Min. SIP Amount

0

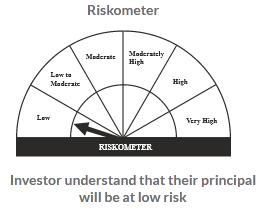

Risk Status

low

Investment Objective :

Fund Performance

3 and 6 Months returns are absolute

NAV Movement

Returns (%)

| 3 Mon | 6 Mon | 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs | |

|---|---|---|---|---|---|---|

| Fund | 1.22 | 2.49 | 5.34 | 0.0 | 0.0 | 0.0 |

| Nifty 1D Rate Index | 1.34 | 2.72 | 5.78 | 6.42 | 5.48 | 5.51 |

| ETFs | 6.92 | 12.48 | 22.66 | 19.87 | 15.36 | 14.83 |

| Rank within Category | ||||||

| Number of Funds within Category |

Peer Comparison

| Return (%) | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | AUM (crore) |

Expense Ratio |

1 Yr | 3 Yrs | 5 Yrs | 10 Yrs |

| Groww Nifty 1D Rate Liquid ETF | 11.7 | 0.29 | 5.34 | 0.0 | 0.0 | 0.0 |

| Tata Silver Exchange Traded Fund | 138.29 | 0.44 | 160.77 | 0.0 | 0.0 | 0.0 |

| HDFC Silver ETF - Growth Option | 375.72 | 0.45 | 158.21 | 47.78 | 0.0 | 0.0 |

| ICICI Prudential Silver ETF | 1,073.9 | 0.4 | 158.04 | 48.04 | 0.0 | 0.0 |

| DSP Silver ETF | 154.89 | 0.4 | 157.77 | 48.27 | 0.0 | 0.0 |

| Aditya Birla Sun Life Silver ETF | 200.48 | 0.35 | 157.69 | 48.17 | 0.0 | 0.0 |

| Kotak Silver ETF | 262.95 | 0.45 | 157.51 | 48.39 | 0.0 | 0.0 |

| Axis Silver ETF | 91.33 | 0.37 | 157.2 | 48.34 | 0.0 | 0.0 |

| Mirae Asset Silver ETF | 56.14 | 0.34 | 157.19 | 0.0 | 0.0 | 0.0 |

| SBI Silver ETF | 277.11 | 0.4 | 156.87 | 0.0 | 0.0 | 0.0 |

Yearly Performance (%)

Historical Returns (%)

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 |

| NIFTY 1D Rate Index | 3.28 | 4.76 | 6.74 | 6.79 |

Returns Calculator

Growth of 10000 In SIP (Fund vs Benchmark)

Growth of 10000 In LUMPSUM (Fund vs Benchmark)

Rolling Returns

Rolling returns are the annualized returns of the scheme taken for a specified period (rolling returns period) on every day/week/month and taken till the last day of the duration. In this chart we are showing the annualized returns over the rolling returns period on every day from the start date and comparing it with the benchmark. Rolling returns is the best measure of a fund's performance. Trailing returns have a recency bias and point to point returns are specific to the period in consideration. Rolling returns, on the other hand, measures the fund's absolute and relative performance across all timescales, without bias.

Fund Multiplier

Riskometer

Asset Allocation

Top 10 Holdings

| Company | Instrument | Credit Rating | Holdings (%) |

|---|

Related Funds in this Category

Sector Allocation (%)

Equity Holdings

| Sector | Allocation (%) |

|---|

Market Cap Distribution

Portfolio Behavior

| Volatility | - |

| Sharp Ratio | - |

| Alpha | - |

| Beta | - |

| Standard Deviation | - |

| Portfolio Turnover |

Extreme Performance

| Time Frame | Period | Fund (%) |

Benchmark (%) |

|---|---|---|---|

| Best Month | 30-05-2014 | 11.64 | 8.11 |

| Worst Month | 31-01-2011 | -10.46 | -10.23 |

| Best Quarter | 30-06-2014 | 20.12 | 14.03 |

| Worst Quarter | 30-09-2011 | -9.40 | -12.11 |

| Best Year | 31-12-2014 | 57.64 | 32.91 |

| Worst Year | 30-12-2011 | -22.29 | -23.81 |